Recreational Marijuana Sales Tax

On April 4, 2023, the City of Columbia and Boone County both passed their recreational (adult use) marijuana tax measures.

The Columbia tax received 12,183 for yes and 5,778 for no.

The Boone County tax received 18,019 for yes votes and 8,462 for no.

These new taxes do not apply to marijuana purchased for medical use.

Scroll to learn more!

Official ballot language

PROPOSITION 1

Shall the municipality of Columbia, Missouri impose an additional sales tax of

three percent (3%) on the retail sale of adult use marijuana?

□ YES

□ NO

If you are in favor of the question, place an “X” in the box opposite “YES”. If you are opposed to the question, place an “X” in the box opposite “NO”.

The Columbia City Council has voted to call a special election on the question of whether to impose an additional 3% sales tax on recreational (adult use) marijuana.

The election will take place Tuesday, April 4, 2023.

The tax, if approved, would not apply to marijuana purchased for medical use.

Official ballot language

PROPOSITION 1

Shall the municipality of Columbia, Missouri impose an additional sales tax of

three percent (3%) on the retail sale of adult use marijuana?

□ YES

□ NO

If you are in favor of the question, place an “X” in the box opposite “YES”. If you are opposed to the question, place an “X” in the box opposite “NO”.

Background information

During the statewide election of November 2022, Missouri voters approved an amendment to the state’s constitution, which made the use and sale of recreational (adult use) marijuana legal in Missouri for adults over the age of 21.

Additionally, the amendment placed a 6% state sales tax on purchases of recreational marijuana and authorized local governments to add a 3% sales tax.

At its Jan. 17, 2023, meeting, Columbia City Council unanimously voted to put a question regarding the additional 3% sales tax on recreational marijuana on the ballot for the April 4 municipal elections.

Currently, more than 100 Missouri municipalities have a recreational marijuana sales tax question on the April ballot, including Kansas City, Joplin and Jefferson City.

Locally, Boone County has its own recreational marijuana sales tax question on the April ballot, as do several municipalities within the county, including Centralia, Sturgeon, Hallsville and Ashland.

Prop 1 explained

Currently a sales tax of 7.975% is collected on all goods purchased in — or for delivery to — the City of Columbia.

The State of Missouri currently collects an additional 6% sales tax on purchases of recreational marijuana.

If voters approve Prop 1, the City of Columbia will collect an additional 3% sales tax on purchases of recreational marijuana made within the City.

The funds collected from the tax would be allocated to the City’s general fund.

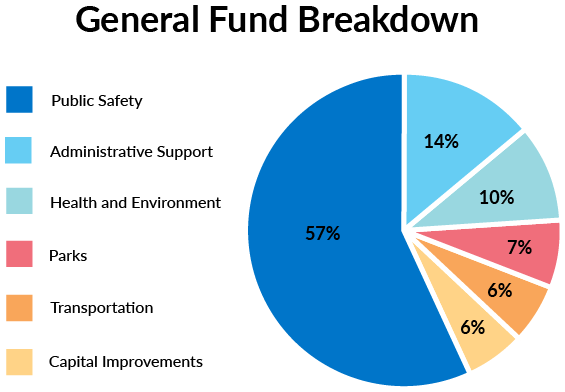

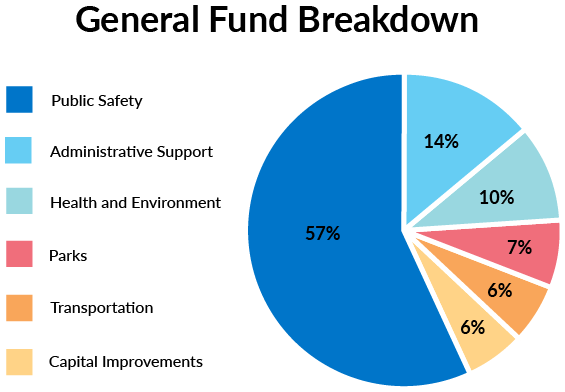

The general fund is then further broken down into public safety, administrative support, health and environment, parks, transportation, and capital improvements.

What would Prop 1 mean for Columbia residents?

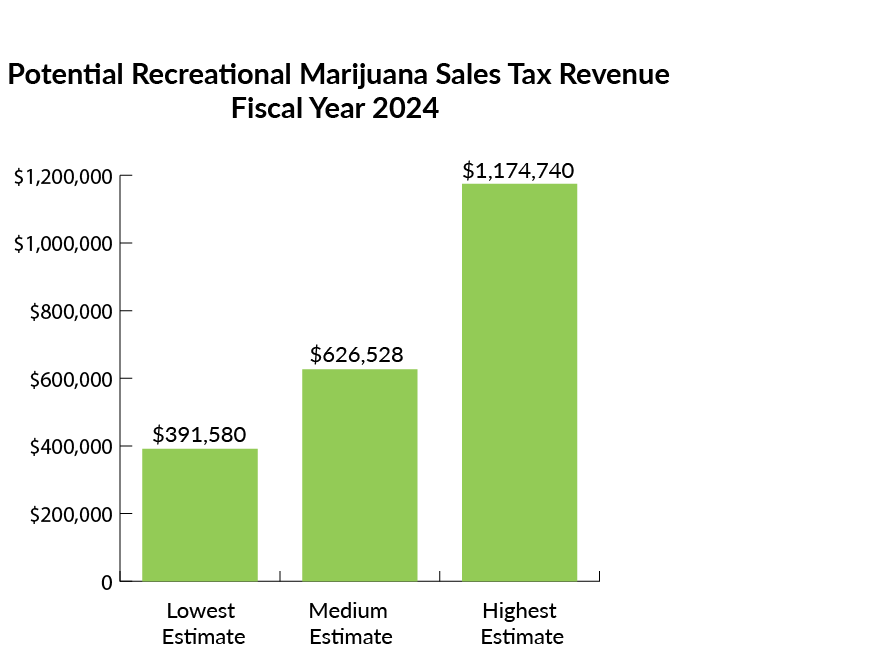

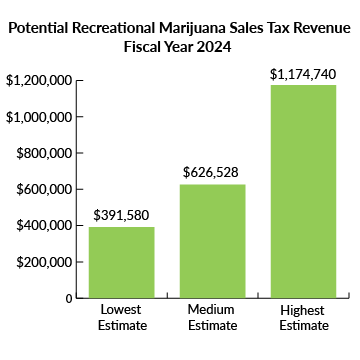

Recreational (adult use) marijuana has only been legal in Missouri for a short time, and it is difficult to accurately estimate how much annual revenue the tax would generate.

The chart to the right provides three estimates for how much revenue the City would collect from the tax should voters to approve it.

If voters approve of the Prop 1 ballot measure, the tax would go into effect Oct. 1, 2023. It is estimated that the City would collect between approximately $400,000 and $1 million in the first year of the tax.

As stated in the previous section, the funds collected from the recreational marijuana sales tax would be allocated to the City’s general fund and could fund public safety, public health and social service initiatives.

Frequently asked questions

Does Boone County also have its own recreational marijuana sales tax question on the April 4 ballot?

Yes. Boone County has also placed its own recreational marijuana sales tax question on the April ballot. That means Columbia residents will see two recreational marijuana questions on the ballot, one for Boone County, and one for the City of Columbia.

Both questions ask voters whether they approve of an additional 3% sales tax on recreational marijuana.

How does the proposed 3% sales tax in Columbia compare to recreational marijuana taxes in other cities?

The proposed tax is comparable to cities throughout the United States. Here are some examples:

- Boulder, Colorado — 3.5%

- Springfield, Illinois — 3%

- Ann Arbor, Michigan — No local tax (Receives 15% of the statewide 10% excise tax, in proportion to the number of marijuana retail stores within the municipality)

- East St. Louis, Illinois — 3%

- Albuquerque, New Mexico — No local tax (Receives 1/3 of the statewide 12% excise tax collected on purchases made within the city)

- Portland, Oregon — 3%

If voters approve Prop 1, by what percentage will purchases of recreational marijuana be taxed?

Currently, a sales tax of 7.975% is collected on all goods purchased in – or for delivery to – the City of Columbia.

Of that 7.975%, 2% is collected by the City of Columbia, while 4.225% is collected by the State of Missouri and 1.75% is collected by Boone County.

The state collects an additional 6% on purchases of recreational marijuana in Missouri.

If voters approve Prop 1, the City of Columbia would collect an additional 3% sales tax on purchases of recreational marijuana.

Would the 3% increase apply to marijuana purchased for medical use?

No. If voters approve Prop 1, the additional 3% sales tax would only apply to marijuana purchased for recreational use.

How will marijuana dispensaries determine whether a purchase is for medical or recreational use?

Any adult over the age of 21 can purchase recreational marijuana from a licensed vendor. Only those with a medical marijuana ID card or caregiver ID card can purchase marijuana for medical purposes.

What would the City do with the revenue generated from the tax?

The funds collected from the recreational marijuana sales tax would be allocated to the City’s general fund and could fund public safety, public health and social service initiatives.

Important documents and finance information

Paid for by the City of Columbia, Missouri. De’Carlon Seewood, City Manager | 701 E. Broadway, P.O. Box 6015, Columbia, MO 65205

Background information

During the statewide election of November 2022, Missouri voters approved an amendment to the state’s constitution, which made the use and sale of recreational (adult use) marijuana legal in Missouri for adults over the age of 21.

Additionally, the amendment placed a 6% state sales tax on purchases of recreational marijuana and authorized local governments to add a 3% sales tax.

At its Jan. 17, 2023, meeting, Columbia City Council unanimously voted to put a question regarding the additional 3% sales tax on recreational marijuana on the ballot for the April 4 municipal elections.

Currently, more than 100 Missouri municipalities have a recreational marijuana sales tax question on the April ballot, including Kansas City, Joplin and Jefferson City.

Locally, Boone County has its own recreational marijuana sales tax question on the April ballot, as do several municipalities within the county, including Centralia, Sturgeon, Hallsville and Ashland.

Prop 1 explained

Currently a sales tax of 7.975% is collected on all goods purchased in — or for delivery to — the City of Columbia.

The State of Missouri currently collects an additional 6% sales tax on purchases of recreational marijuana.

If voters approve Prop 1, the City of Columbia will collect an additional 3% sales tax on purchases of recreational marijuana.

The funds collected from the tax would be allocated to the City’s general fund.

The general fund is then further broken down into public safety, administrative support, health and environment, parks, transportation, and capital improvements.

What would Prop 1 mean for Columbia residents?

Recreational (adult use) marijuana has only been legal in Missouri for a short time, and it is difficult to accurately estimate how much annual revenue the tax would generate.

The chart to the right provides three estimates for how much revenue the City would collect from the tax should voters to approve it.

If voters approve of the Prop 1 ballot measure, the tax would go into effect Oct. 1, 2023. It is estimated that the City would collect between approximately $400,000 and $1 million in the first year of the tax.

As stated in the previous section, the funds collected from the recreational marijuana sales tax would be allocated to the City’s general fund and could fund public safety, public health and social service initiatives.

Frequently asked questions

Does Boone County also have its own recreational marijuana sales tax question on the April 4 ballot?

Yes. Boone County has also placed its own recreational marijuana sales tax question on the April ballot. That means Columbia residents will see two recreational marijuana questions on the ballot, one for Boone County, and one for the City of Columbia.

Both questions ask voters whether they approve of an additional 3% sales tax on recreational marijuana.

How does the proposed 3% sales tax in Columbia compare to recreational marijuana taxes in other cities?

The proposed tax is comparable to cities throughout the United States. Here are some examples:

- Boulder, Colorado — 3.5%

- Springfield, Illinois — 3%

- Ann Arbor, Michigan — No local tax (Receives 15% of the statewide 10% excise tax, in proportion to the number of marijuana retail stores within the municipality)

- East St. Louis, Illinois — 3%

- Albuquerque, New Mexico — No local tax (Receives 1/3 of the statewide 12% excise tax collected on purchases made within the city)

- Portland, Oregon — 3%

If voters approve Prop 1, by what percentage will purchases of recreational marijuana be taxed?

Currently, a sales tax of 7.975% is collected on all goods purchased in – or for delivery to – the City of Columbia.

Of that 7.975%, 2% is collected by the City of Columbia, while 4.225% is collected by the State of Missouri and 1.75% is collected by Boone County.

The state collects an additional 6% on purchases of recreational marijuana in Missouri.

If voters approve Prop 1, the City of Columbia would collect an additional 3% sales tax on purchases of recreational marijuana.

Would the 3% tax apply to marijuana purchased for medical use?

No. If voters approve Prop 1, the additional 3% sales tax would only apply to marijuana purchased for recreational use.

How will marijuana dispensaries determine whether a purchase is for medical or recreational use?

Any adult over the age of 21 can purchase recreational marijuana from a licensed vendor. Only those with a medical marijuana ID card or caregiver ID card can purchase marijuana for medical purposes.

What would the City do with the revenue generated from the tax?

The funds collected from the recreational marijuana sales tax would be allocated to the City’s general fund and could fund public safety, public health and social service initiatives.

Important documents and finance information

Paid for by the City of Columbia, Missouri. De’Carlon Seewood, City Manager | 701 E. Broadway, P.O. Box 6015, Columbia, MO 65205